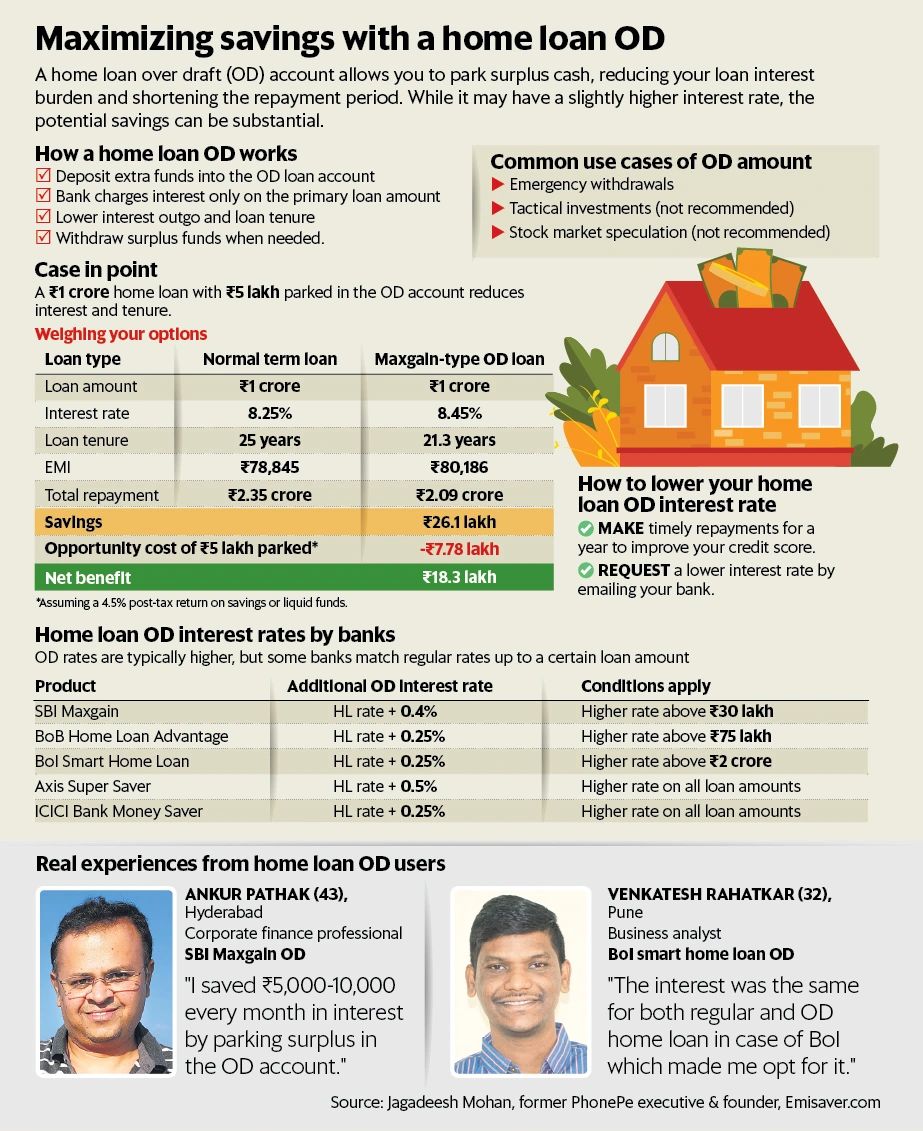

Upgrade to smart home loan, saving lacs in interest

Save money, time and effort for life with EMI Saver. We help you navigate the complexities of home loans and secure the best rates.

Trusted by homeowners across India