Ever wondered, How does your Home loan interest change?

Home loans are the biggest purchase in an individuals life. In India its mostly an emotional purchase. It signifies a lot more than a place to stay, it means that you have stability, safety, success and are settled. As the housing prices have raced in that last 3 years, most people are forced to opt for a Home loan. If you take 1 Cr loan for 25 years, you will end up repaying more than double the amount in interest.

We spend so much time reading about growing in our careers, how to invest better, this is an article that will talk about how to spend better or smarter.

Home loans, have 3 main parts,

- 1. Loan value - How much loan you take

- 2. Tenure - How many years for which you take the loan

- 3. Rate of interest - What does the loan cost you

Today we will focus on Rate of interest.

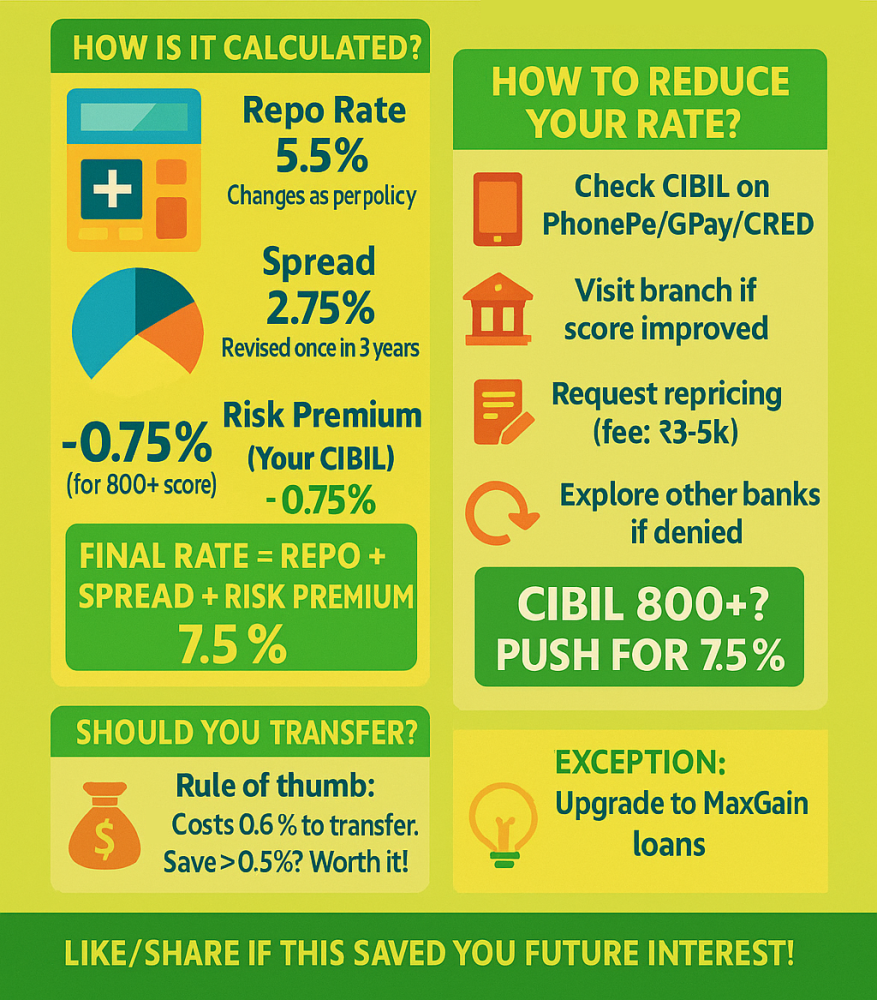

How is it calculated ?

Home loan rates are determined by 3 parts,

- 1. Repo rate - decided by RBI - Changes as per their policy

- 2. Spread - decided by Bank - Revised once in 3 years

- 3. Risk premium - decided on basis of your Cibil score - Revised annually

So if you have a cibil score of 800+ then your ROI should come down to 7.5% or lower as per the below calculation

- 1. Repo rate =5.5%

- 2. Spread = 2.75%

- 3. Risk premium = -0.75%

Final rate = 7.5%

Ok, how do I get it reduced?

- 1. Check your cibil score on PhonePe, Gpay or Cred

- 2. If it has improved then visit your branch

- 3. Submit a request for repricing the loan, they will charge 3-5k as admin fees

- 4. If they dont agree, you can explore other banks

Does it make sense to transfer?

Simple rule of thumb, it will cost 0.6-0.9% to transfer the loan. If you can save 0.5% in interest then makes sense to go through the transfer. Else you can transfer only for an upgrade to Maxgain Home loans.

I am building in this space and working on teaching people

to manage their Home loans better. If you have any questions

around Home loans, book time for a free session

- https://calendar.app.google/gwhAbSPTTgrW8YYf7